|

UPDATE as of 02/28/2018

1. ECS has confirmed with its CMS sources that the Work GPCI

issue as discussed below will be retroactive to 01/01/2018.

2. Medicare Contractor Updates... - WPS Medicare - has posted information on their website (see

original link below)

- Noridian - has updated their fee schedules, but there is no

explanation on their website of how they will reprocess previously paid

claims

- Palmetto GBA - has updated their fee schedules, but there is no

explanation on their website of how they will reprocess previously paid claims

- Novitas - has updated their fee schedules, but there is no

explanation on their website of how they will reprocess previously paid claims

- First Coast Services - has updated their fee schedules, but there

is no explanation on their website of how they will reprocess previously paid

claims

- CGS Medicare - has updated their fee schedules, but there is no

explanation on their website of how they will reprocess previously paid claims

3. On 2/28/2018 - CMS released an updated summary today which has this

tidbit...

"For Sections 50201 “Extension of Work Geographic Practice Cost Index

(GPCI) Floor”, 50202 “Repeal of

Medicare Payment Cap for Therapy Services; Limitation to Ensure Appropriate

Therapy”, and 50203

“Medicare Ambulance Services” provision changes, Medicare

Administrative Contractors (MAC) will

implement these changes no later than February 26, 2018, and will provide

additional details on

timelines for reprocessing or release of held claims impacted by these changes.

The following are

brief descriptions of these provisions:"

Section 50201 - Extension of Work Geographic Practice Cost Index (GPCI) Floor -

The new law

extends a provision raising the Work GPCI to 1.000 for all localities that

currently have a Work

GPCI of less than 1.000. The Work GPCI Floor impacts the fees for all codes

paid under the

Medicare Physician Fee Schedule (MPFS) for those localities. The Work GPCI

floor is extended

through December 31, 2019. No new provider action is necessary for

implementation.

Source: https://www.cms.gov/Center/Provider-Type/All-Fee-For-Service-Providers/Downloads/Medicare-Expired-Legislative-Provisions-Extended.pdf

4. Our last bit of advice is UPDATE Your Fee Schedule to these

new rates!!! If you continue to underbill, you may get underpaid.

===================================================================================================

By: Karl M. Ellzey, President, Ellzey Coding Solutions

Original Date of Publication: February 23, 2018

Ellzey Coding Solutions is alerting all Dermatologists and staff on an interesting issue that has come about as

part of the recently passed 2018 Federal Budget.

This issue will affect Medicare reimbursement rates (POSITIVELY) for

providers in 53 of the 112 Medicare payment localities.

In addition to funding the government, extending CHIP and other healthcare

programs, part of the Federal budget passed a few weeks ago included a quietly

released tidbit within the "Sustain Care Act of 2018"

You can read about the entire Act here...

https://rules.house.gov/sites/republicans.rules.house.gov/files/115/PDF/sxs_summary.pdf

The Sustain Care Act of 2018 (Section 2112) re-instated the Work GPCI (work

geographic adjustment factor) floor of 1.000 which will positively affect the

2018 Medicare Physician Fee Schedules Rates in certain Medicare payment

localities.

A little background... The Work GPCI is just one of several components and

variables used in the calculation of the physician fee schedule for each of the

112 Medicare payment localities. CMS uses the "national average"

geographic adjustment factors of 1.000 to represent the median for all Medicare

localities. Some variables are adjusted higher, and some are adjusted lower for

each locality based on geographic factors such as cost of living, cost of malpractice

insurance, wages, rent, etc. For example, the geographic adjustment factors for

providers in Mississippi are weighted less than the adjustment factors for

physicians practicing in Manhattan, NY.

Prior to 2018, as part of compromises to avoid massive payment reductions for

physician fee schedules (remember the Sustainable Growth Rate issues providers

faced for 10 years?), CMS placed a lower limit or "floor" value of

1.000 for the Work GPCI, even if a locality had a predetermined work adjustment

factor of less than 1.000. For example, the Work GPCI for Missouri

in January was calculated at a value of 0.961. Unfortunately, the previous

provision that allowed for this "floor" of 1.000 expired

12/31/2017.

This meant that starting January 1, and prior to the recently passed budget, 53

of the 112 Medicare payment localities used Work GPCI values of less than 1.000

in calculating the published 2018 Medicare Physician Fee Schedule rates. This

meant that up until this Act was passed, many physician practices have

been billing and being paid at lower reimbursement rate than will soon

be in effect once CMS finalizes these new payment changes.

Example 1: A provider in Mississippi that does Mohs (CPT 17311)

will now get paid $601.89 vs. $593.19

Example 2: A provider in Missouri that destroys 15 or more AKs (CPT

17004) will now get paid $131.72 vs. $129.79

Example 3: A provider in Chicago, Illinois will not be affected by

this policy change as their Work GPCI is currently already above 1.000 (1.008)

Some of these changes may seem small, but they can add up over the course of a

year if you underbill or have significant Medicare volume.

On Friday, February 23, CMS published updated 2018 Relative Value Unit files

that reflect the 1.000 Work GPCI floor that is now in place.

What CMS has not made clear...

1. Is the Work GPCI calculation retroactive to all claims

filed/paid as of 1/1/2018 or starting at a certain date?

Update on 02/26/2018 - CMS has confirmed this

is retroactive to 01/01/2018

2. If these changes are retroactive to 1/1/2018, will Medicare

contractors retroactively adjust and make a bulk payment adjustmentsto

all providers that had claims previously paid at the lower rates?

Update on 02/26/2018 - CMS has confirmed that Medicare

contractors will make the appropriate adjustments and reprocess claims

As of 02/23/2018 CMS and the Medicare contractors have released very little information

about this important change.... or at least remained relatively quiet

about it!

As of February 23, 2018...

Noridian Medicare has no information about this

change on their website for providers located in Arizona, Idaho, Montana, North

Dakota, Oregon, Utah, Washington, and Wyoming.

Source: https://med.noridianmedicare.com/web/jfb/fees-news/fee-schedules/mpfs

Palmetto GBA has no information in its website regarding these

changes. This affects North Carolina, South Carolina, West Virginia, and

Virginia!

Source: https://www.palmettogba.com/palmetto/providers.nsf/DocsCatHome/JM%20Part%20B

Novitas Solutions has no information in its website regarding these

changes. This affects Arkansas, Colorado, Louisiana, Mississippi, New Mexico, Oklahoma,

and parts of Texas.

Source: https://www.novitas-solutions.com/webcenter/portal/FeeSchedules_JH

First Coast Service Options which affects providers in Florida, PR,

and the USVI has no updates yet!

Source: https://medicare.fcso.com/Landing/140047.asp

CGS Medicare which affects providers in Kentucky and Ohio has no

updates on their site!

Source: https://cgsmedicare.com/partb/fees/index.html

However, we did find one carrier (WPS Government Health

Administrators) which has indicated that the change is effective for

claims processed ON and AFTER 2/16/2018. Updated fees are available

on their website and affects providers in Iowa, Kansas, Missouri and Nebraska.

Source: https://www.wpsgha.com/wps/portal/mac/site/fees-and-reimbursements/guides-and-resources/2018-fee-schedule

Will other carriers follow? What about claims prior to 2/16/2018?

Update on 02/26/2018 - CMS has confirmed that this will be

retroactive!

Ellzey Coding Solutions has reached out to it's contacts at CMS to get

additional clarification or instructions on what is supposed to happen with the

new Work GPCI floor limits and how it affects the first 7 weeks of claims

processed in 2018!

Ellzey Coding Solutions recommends seeing if you are impacted

by this change, and making any changes/updates in your billing systems,

especially if you submit the actual Medicare allowables to Medicare (i.e., no

Medicare fee schedule mark-up).

If you currently have an office fee schedule that his higher than

Medicare and you submit these higher rates to Medicare, you should be OKAY, but

watch your EOBs for correct payments!

To see how you will be impacted by this change, check your State/Locality in

the listing below. If a Work GPCI value of less than 1.000 is displayed, you

will be affected.

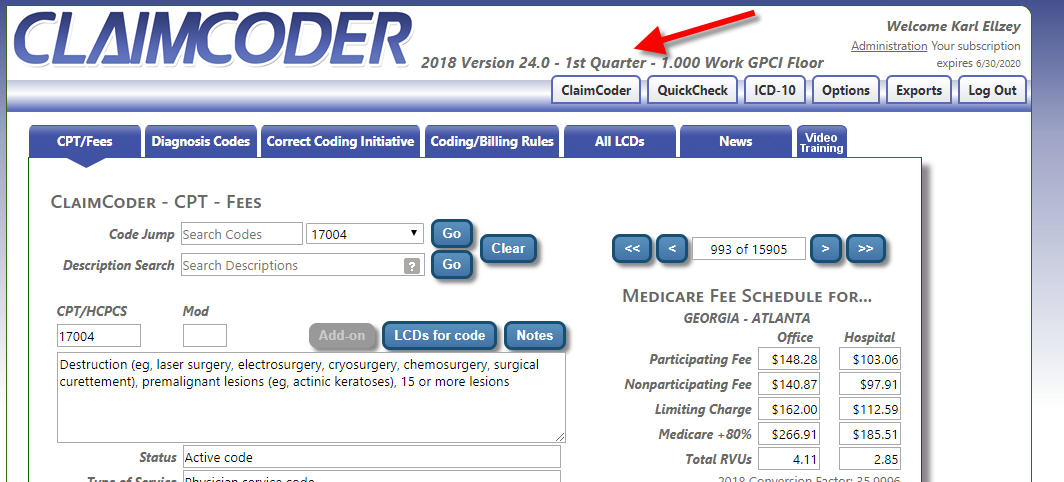

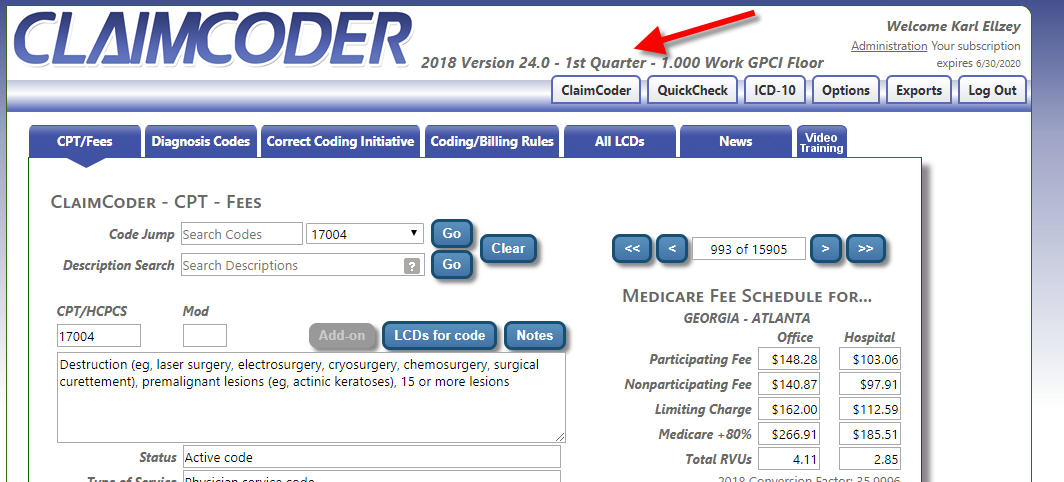

DermCoder.com and ClaimCoder.com have been defaulted to the revised/updated 2018 Fee Schedules!

DermCoder.com or ClaimCoder.com 30-day Free Trial

If you are not currently a subscriber (or past subscriber), you may be eligible* for a 30-day free trial to DermCoder.com or ClaimCoder.com.

Visit: www.dermcoder.com/register or www.claimcoder.com/register

* Certain restrictions apply

Are you affected?

Here is a listing of Work GPCIs (by Medicare Payment Locality) that were in

place earlier this year...

If you see a value of less than 1.000, you will be affected by this change!

Locality Name Work GPCI prior to new budget

ALABAMA - STATEWIDE 0.979

ALASKA - STATEWIDE 1.500

ARIZONA - STATEWIDE 0.980

ARKANSAS - STATEWIDE 0.971

CALIFORNIA - BAKERSFIELD 1.020

CALIFORNIA - CHICO 1.020

CALIFORNIA - EL CENTRO 1.020

CALIFORNIA - FRESNO 1.020

CALIFORNIA - HANFORD-CORCORAN 1.020

CALIFORNIA - LOS ANGELES-LONG BEACH-ANAHEIM (LOS ANGELES

CTY 1.046

CALIFORNIA - LOS ANGELES-LONG BEACH-ANAHEIM (ORANGE

CNTY) 1.046

CALIFORNIA - MADERA 1.020

CALIFORNIA - MERCED 1.020

CALIFORNIA - MODESTO 1.020

CALIFORNIA - NAPA 1.055

CALIFORNIA - OXNARD-THOUSAND OAKS-VENTURA 1.024

CALIFORNIA - REDDING 1.020

CALIFORNIA - REST OF STATE 1.020

CALIFORNIA - RIVERSIDE-SAN BERNARDINO-ONTARIO 1.020

CALIFORNIA - SACRAMENTO--ROSEVILLE--ARDEN-ARCADE 1.025

CALIFORNIA - SALINAS 1.024

CALIFORNIA - SAN DIEGO-CARLSBAD 1.022

CALIFORNIA - SAN FRANCISCO-OAKLAND-HAYWARD (ALAMEDA/CONTRA

C 1.075

CALIFORNIA - SAN FRANCISCO-OAKLAND-HAYWARD (MARIN

CNTY) 1.062

CALIFORNIA - SAN FRANCISCO-OAKLAND-HAYWARD (SAN FRANC

CNTY) 1.075

CALIFORNIA - SAN FRANCISCO-OAKLAND-HAYWARD (SAN MATEO

CNTY) 1.075

CALIFORNIA - SAN JOSE-SUNNYVALE-SANTA CLARA (SAN BENITO

CTY 1.041

CALIFORNIA - SAN JOSE-SUNNYVALE-SANTA CLARA (SANTA CLARA

CTY 1.083

CALIFORNIA - SAN LUIS OBISPO-PASO ROBLES-ARROYO

GRANDE 1.020

CALIFORNIA - SANTA CRUZ-WATSONVILLE 1.026

CALIFORNIA - SANTA MARIA-SANTA BARBARA 1.028

CALIFORNIA - SANTA ROSA 1.023

CALIFORNIA - STOCKTON-LODI 1.020

CALIFORNIA - VALLEJO-FAIRFIELD 1.055

CALIFORNIA - VISALIA-PORTERVILLE 1.020

CALIFORNIA - YUBA CITY 1.020

COLORADO - STATEWIDE 0.996

CONNECTICUT - STATEWIDE 1.021

DELAWARE - STATEWIDE 1.007

DISTRICT OF COLUMBIA - DC + MD/VA SUBURBS 1.045

FLORIDA - FORT LAUDERDALE 0.983

FLORIDA - MIAMI 0.990

FLORIDA - REST OF STATE 0.975

GEORGIA - ATLANTA 0.998

GEORGIA - REST OF STATE 0.980

HAWAII/GUAM - STATEWIDE 1.001

IDAHO - STATEWIDE 0.962

ILLINOIS - CHICAGO 1.008

ILLINOIS - EAST ST. LOUIS 0.984

ILLINOIS - REST OF STATE 0.982

ILLINOIS - SUBURBAN CHICAGO 1.009

INDIANA - STATEWIDE 0.969

IOWA - STATEWIDE 0.969

KANSAS - STATEWIDE 0.966

KENTUCKY - STATEWIDE 0.974

LOUISIANA - NEW ORLEANS 0.987

LOUISIANA - REST OF STATE 0.977

MAINE - REST OF STATE 0.970

MAINE - SOUTHERN MAINE 0.980

MARYLAND - BALTIMORE/SURR. CNTYS 1.023

MARYLAND - REST OF STATE 1.009

MASSACHUSETTS - METROPOLITAN BOSTON 1.033

MASSACHUSETTS - REST OF STATE 1.020

MICHIGAN - DETROIT 1.000

MICHIGAN - REST OF STATE 0.978

MINNESOTA - STATEWIDE 0.998

MISSISSIPPI - STATEWIDE 0.961

MISSOURI - METROPOLITAN KANSAS CITY 0.984

MISSOURI - METROPOLITAN ST. LOUIS 0.985

MISSOURI - REST OF STATE 0.961

MONTANA - STATEWIDE 0.965

NEBRASKA - STATEWIDE 0.970

NEVADA - STATEWIDE 1.002

NEW HAMPSHIRE - STATEWIDE 0.991

NEW JERSEY - NORTHERN NJ 1.041

NEW JERSEY - REST OF STATE 1.024

NEW MEXICO - STATEWIDE 0.982

NEW YORK - MANHATTAN 1.052

NEW YORK - NYC SUBURBS/LONG ISLAND 1.041

NEW YORK - POUGHKPSIE/N NYC SUBURBS 1.016

NEW YORK - QUEENS 1.052

NEW YORK - REST OF STATE 0.987

NORTH CAROLINA - STATEWIDE 0.975

NORTH DAKOTA - STATEWIDE 0.978

OHIO - STATEWIDE 0.990

OKLAHOMA - STATEWIDE 0.961

OREGON - PORTLAND 1.010

OREGON - REST OF STATE 0.991

PENNSYLVANIA - METROPOLITAN PHILADELPHIA 1.022

PENNSYLVANIA - REST OF STATE 0.990

PUERTO RICO - PUERTO RICO 0.998

RHODE ISLAND - STATEWIDE 1.027

SOUTH CAROLINA - STATEWIDE 0.977

SOUTH DAKOTA - STATEWIDE 0.961

TENNESSEE - STATEWIDE 0.976

TEXAS - AUSTIN 0.994

TEXAS - BEAUMONT 0.985

TEXAS - BRAZORIA 1.020

TEXAS - DALLAS 1.012

TEXAS - FORT WORTH 1.007

TEXAS - GALVESTON 1.020

TEXAS - HOUSTON 1.020

TEXAS - REST OF STATE 0.990

UTAH - STATEWIDE 0.980

VERMONT - STATEWIDE 0.979

VIRGIN ISLANDS - VIRGIN ISLANDS 0.998

VIRGINIA - STATEWIDE 0.992

WASHINGTON - REST OF STATE 0.997

WASHINGTON - SEATTLE 1.027

WEST VIRGINIA - STATEWIDE 0.966

WISCONSIN - STATEWIDE 0.983

WYOMING - STATEWIDE 0.983

This article is copyrighted, 2018, by Ellzey Coding Solutions, Inc. and may not be reproduced or reprinted without the express written consent of the author.

|